Understand market signals: how the attachment (USDT) influences trading

The world of cryptocurrencies has become more and more volatile in recent years, the fluctuating prices wildly due to various market signals. In this article, we will immerse ourselves in the world of trading of cryptocurrencies and explore how a major actor like Tether (USDT) can significantly influence negotiation decisions.

What is the attachment?

Tether (USDT) is a stablecoin, which means that it is set at the value of the US dollar. Created in 2014 by Bitfinex, an exchange of leading cryptocurrency, Tether aims to provide a stable and secure means for merchants to buy, sell and exchange cryptocurrencies with fiduciary currencies like the USD . With a market capitalization of more than $ 40 billion, Tether is one of the largest and most used cryptocurrencies.

How does the attachment influence trading?

Tether’s influence on trading can be seen in several ways:

- Price Directorate : Tether’s Stablecoin status means that its value is closely linked to the US dollar. This creates a direct relationship between the price of the attachment (USDT) and the wider market of cryptocurrencies. While the prices of other cryptocurrencies fluctuate, the value of the attachment (USDT) tends to follow the plunge.

- Senture of the market : The stability of the attachment (USDT) can influence the feeling of the market. If traders see a lot of purchase interest in the USDT, they can assume that there is a strong support for the entire cryptocurrency market and buy more, which has increased prices. Conversely, if there is little request or purchase pressure, prices tend to drop.

- Order flow : Tether Stablecoin status can also affect the dynamics of command flows on the market. While traders place orders in the USDT, it tends to further attract the attention of other investors, influencing their commercial decisions.

- Price volatility : The attachment (USDT) is often used as a reference price for other cryptocurrencies, so that its fluctuations tend to affect the wider market of cryptocurrencies.

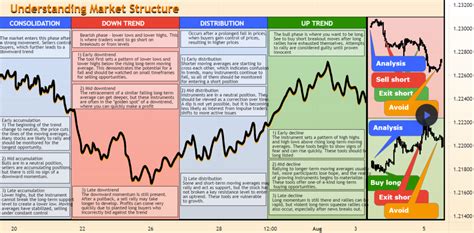

Market signals and trading

During the analysis of market signals that influence trade in the context of the attachment (USDT), traders should keep in mind the following points:

- Trend Trend : Traders can use Tether’s Stablecoin status as a reference to identify the potential trends of other cryptocurrencies.

- Management and resistance : USDT price movements often create solid support and resistance levels, which can be used as references for other cryptocurrency markets.

- Volume and order flow : Strong volume and command flow indicators on exchanges where the attachment (USDT) is listed can report a potential for purchasing or selling opportunities in other crypto -Monnaies.

- Fundamental analysis : Traders should take into account fundamental factors such as market capitalization, adoption rates and use cases to assess the overall health of a cryptocurrency before taking commercial decisions.

Conclusion

In conclusion, understanding market signals like Tether (USDT) is essential for any trader or investor who seeks to sail in the complex world of cryptocurrencies. By recognizing how the status of Stablecoin de Tether influences negotiation decisions, traders can make more enlightened choices and potentially benefit from its price movements. While the cryptocurrency market continues to evolve, it will be crucial to stay up to date with the latest trends, signals and dynamics of the market.

Recommended resources:

* TETHER (USDT) White Book : A complete overview of the origins, design and operational principles of TETHER.

* Index of the feeling of the Coindesk cryptography market : An analysis of the feeling of the cryptocurrency market based on various indicators and measures.

* Analysis of cryptoslate attachment prices (USDT) : In-depth analysis of attachment price movements (USDT) and potential trends in the wider market of cryptocurrencies.

Non-responsibility clause:

This article is for information purposes only and should not be considered as investment advice.