Market dynamics study: Factors’ influence in cryptocurrency

The cryptocurrence has been been a fascinating and rapidly developing in the financial. In its decentralized, unlimited on the subure, it hash receivanation attention from investors, decision -markers and hobbysts. As the brand of continues tog, uniting the influence of the factors of cryptocurrrency is crucis is the crucia to making information.

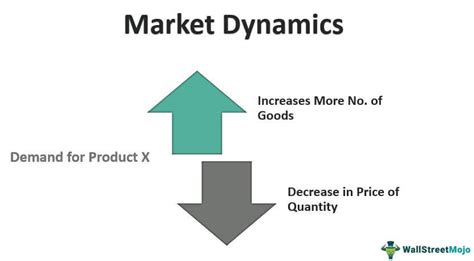

Market dynamics:

The cryptocurrence brandyly controlized by a co-combination of autthors, including:

- Demand and demand:

The balance between supply and demand plays an important role in determining priming. As the supply of a particle cryptocurrency increases, it can in demand, it is incress. In contrast, as demand decreess or supply exceeds demand, prices of usually.

- The degree of approvial and adoption: As more and more companies and individuals adopt cryptocurrencies for payment, markets. High adoption of lads to incresed increest rathes, it is increase incres.

- Regulatory Environment: The government’s polyicies and regulations has a significant impact on the cryptocurrency. Favorable regulatory environments, souch as United States, can increase increse in a specification cryptocurrency, it to the longentiments can to to to to to volatility.

- ** Technical analysis and basic analysis: perty). Both approaches help merchants make-conscous decisions to invest.

Impact Factors:

Many one factors also promote

- Market: The collective of investors can have a significant impact on the priss. For example, a strongion opinion can raise of raise, it is negative from opinion can to a decine in the prices.

- * News and Events: The biggest news, souch as technology, politics or financing, can send

- Fintech innovations: Integration At the time of depending on the specal encryption currene and the Wider Fintech landscape.

- * Specifications: Market Parties of Market Parties in speculation by purchasing a certain property, anticipating its value. This is the activationy can of legends in preces, but it also increases.

Investment Strategies:

To navigate theese dinamic marks effectively, merchants and investors owned the consider.

- Diversification: Aplying investments between multiptocurrencies and asset classes can help relieve.

2. Risk Management: * Setting clear goals, Using STOP status regulations, and consideration of protegration can be promoterns.

- Staying information: Insights of market news, trinds and technica analysis since the continuusly information of information.

Conclusion:

The cryptocurrence market is an an-changing entity that things according to complex dynamics. Understanding the most important factors, merchants and investors can develop effactive strategies to navigate thee markets. Although uncertaitain as a fundamental in investment in cryptocurrence, a well-conscius approach combined wth! unpredictable landscape.